The lease arrangement includes the owner-lessor concurs to rent an asset (machinery, products, land, or building) to the tenant-lessee for the set number of periods for a fixed rental fee per period. Leases can be broadly grouped as either operating leases or capital leases. If the lease agreement coach transfers a material ownership interest from your lessor to the lessee, this is a capital lease. If not, it can be an operating lease. Material control interests, operating leases, capital leases, and sales-leaseback arrangements are the actual subjects of this chapter and you will be discussed in detail in the following pages.

Operating Leases

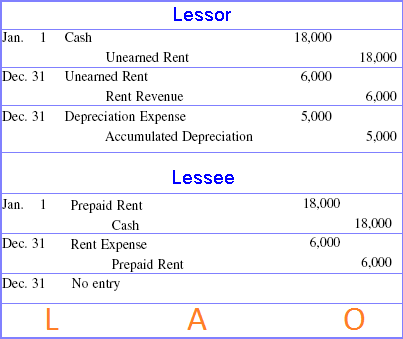

Operating leases will be the simplest type of lease agreement from an accounting viewpoint. The rentals are regarded as being revenue to the owner-lessor and expenses to the tenant-lessee. If rentals are received ahead of time, they should be recorded seeing that un-earned rent (a liability) from the lessor and as prepaid rent (an asset) from the lessee. As time goes by simply, adjusting entries should be made to slowly recognize these items seeing that revenue and expense, respectively. Also, the lessor should be the one to record the annual depreciation entry because asset still belongs to him or her.

Example:

On January 1, 20X5, Lessor rents a building for three years to Lessee at a set rental of $6, 000 a year. The total rental of $18, 000 is actually received immediately. The building price Lessor $25, 000 and features a life of 5 years without salvage value. The journal records for year 1 are:

Operating Leases

Operating leases will be the simplest type of lease agreement from an accounting viewpoint. The rentals are regarded as being revenue to the owner-lessor and expenses to the tenant-lessee. If rentals are received ahead of time, they should be recorded seeing that un-earned rent (a liability) from the lessor and as prepaid rent (an asset) from the lessee. As time goes by simply, adjusting entries should be made to slowly recognize these items seeing that revenue and expense, respectively. Also, the lessor should be the one to record the annual depreciation entry because asset still belongs to him or her.

Example:

On January 1, 20X5, Lessor rents a building for three years to Lessee at a set rental of $6, 000 a year. The total rental of $18, 000 is actually received immediately. The building price Lessor $25, 000 and features a life of 5 years without salvage value. The journal records for year 1 are:

Well written post!

ReplyDeleteLease accounting software